Navigate Your Online Tax Return in Australia: Important Resources and Tips

Browsing the on-line income tax return procedure in Australia needs a clear understanding of your responsibilities and the sources offered to improve the experience. Vital papers, such as your Tax File Number and income declarations, have to be meticulously prepared. Additionally, picking an ideal online system can dramatically influence the effectiveness of your filing process. As you consider these variables, it is crucial to also be mindful of common risks that many experience. Comprehending these nuances could ultimately save you time and minimize stress-- causing a more desirable outcome. What strategies can best help in this venture?

Understanding Tax Obligations

People have to report their income accurately, which includes wages, rental income, and investment earnings, and pay tax obligations accordingly. Residents should comprehend the difference between taxable and non-taxable revenue to make certain conformity and enhance tax results.

For organizations, tax obligation responsibilities encompass numerous elements, including the Item and Solutions Tax (GST), firm tax obligation, and payroll tax obligation. It is essential for companies to register for an Australian Business Number (ABN) and, if suitable, GST enrollment. These responsibilities demand meticulous record-keeping and timely entries of tax returns.

Additionally, taxpayers need to recognize with offered reductions and offsets that can ease their tax problem. Seeking suggestions from tax obligation experts can offer beneficial understandings right into optimizing tax positions while guaranteeing compliance with the law. Generally, a comprehensive understanding of tax responsibilities is important for effective monetary preparation and to prevent charges connected with non-compliance in Australia.

Essential Papers to Prepare

Additionally, compile any relevant bank statements that mirror passion earnings, along with returns declarations if you hold shares. If you have other incomes, such as rental residential or commercial properties or freelance work, ensure you have records of these incomes and any kind of linked costs.

Take into consideration any kind of personal health insurance coverage statements, as these can affect your tax obligation responsibilities. By gathering these crucial papers in advancement, you will certainly simplify your on the internet tax obligation return procedure, decrease errors, and take full advantage of potential refunds.

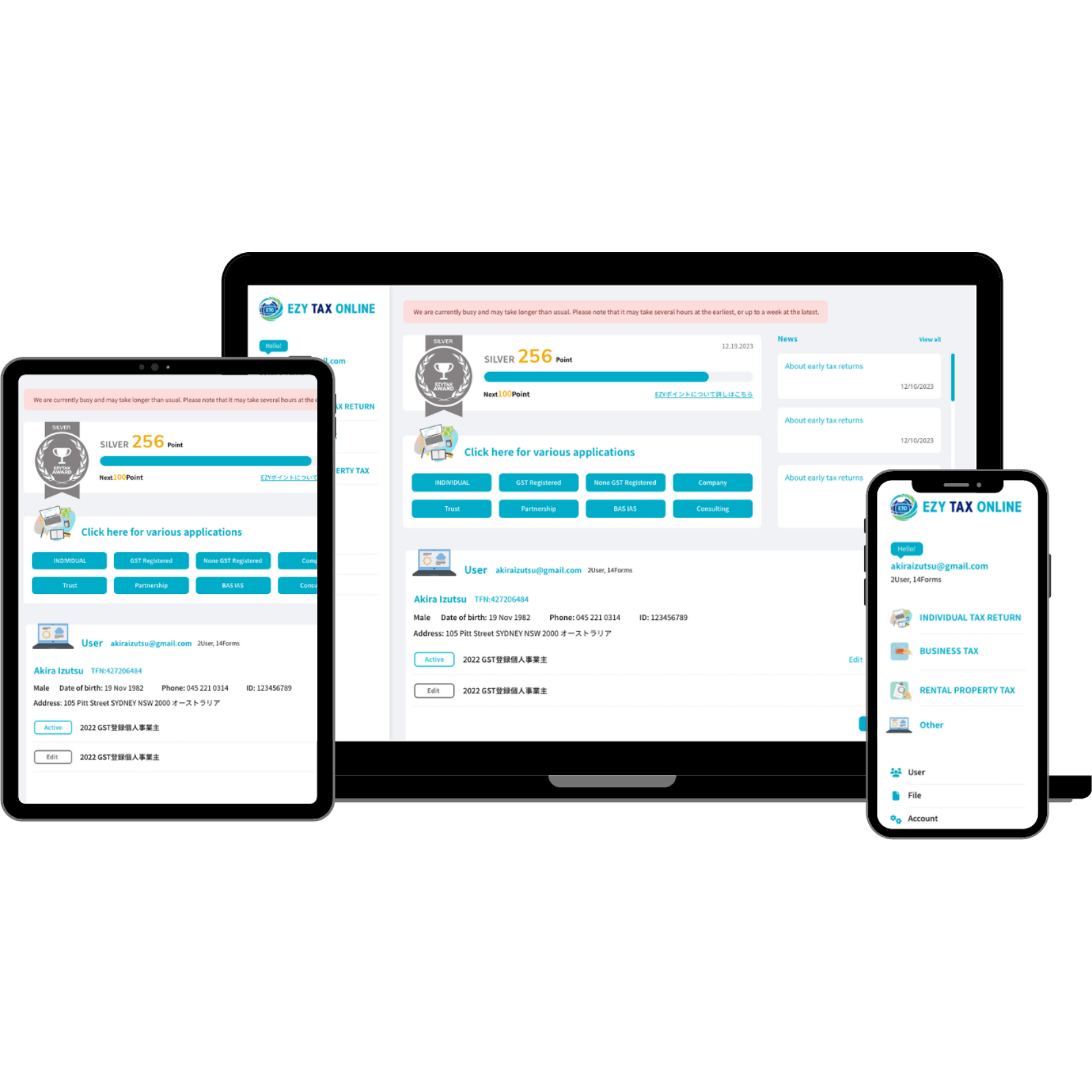

Selecting the Right Online System

As you prepare to file your online tax return in Australia, picking the right platform is necessary to ensure accuracy and simplicity of usage. An uncomplicated, intuitive style can dramatically enhance your experience, making it simpler to navigate complicated tax obligation kinds.

Following, assess the platform's compatibility with your monetary scenario. Some services cater specifically to individuals with simple income tax return, while others provide extensive assistance for much more intricate situations, such as self-employment or financial investment revenue. Look for systems that use real-time error checking and assistance, helping to reduce mistakes and ensuring conformity with Australian tax obligation regulations.

One more crucial aspect to great site think about is the level of consumer assistance offered. Trustworthy systems ought to provide accessibility to help by means of phone, conversation, or e-mail, specifically during peak filing durations. Furthermore, research study user evaluations and scores to evaluate the overall fulfillment and dependability of the platform.

Tips for a Smooth Filing Process

Submitting your on the internet tax return can be an uncomplicated process if you follow a few key pointers to make sure efficiency and precision. Initially, gather all essential papers prior to starting. This includes your revenue statements, invoices for reductions, and any type of various other relevant documents. Having every little thing at hand lessens interruptions and errors.

Next, make use of the pre-filling function supplied by several online platforms. This can save time and decrease the possibility of blunders by instantly populating your return with information from previous years and data offered by your company and banks.

Additionally, double-check all entries for accuracy. online tax return in Australia. Mistakes can result in delayed refunds or problems with the Australian Tax Office (ATO) Make certain that your personal details, earnings numbers, and reductions are proper

Filing early not only reduces stress but also enables for much better planning if you owe tax obligations. By adhering to these ideas, you can browse the online tax return process efficiently and confidently.

Resources for Assistance and Support

Browsing the complexities of on-line income tax return can sometimes be difficult, yet a range of resources for help and support are easily offered to assist taxpayers. The Australian Taxes Office (ATO) is the key source of info, offering detailed overviews on its site, consisting of FAQs, educational videos, and live conversation options for real-time assistance.

Furthermore, the ATO's phone support line is available for those that choose straight interaction. online tax return in Australia. Tax experts, such as authorized tax obligation representatives, can additionally offer individualized advice and ensure compliance with existing tax obligation policies

Conclusion

In conclusion, efficiently browsing the on the internet income tax return process in Australia calls his comment is here for a comprehensive understanding of tax responsibilities, careful prep work of essential documents, and careful selection of read this article a suitable online platform. Complying with functional ideas can boost the filing experience, while available resources supply valuable support. By approaching the process with diligence and attention to information, taxpayers can guarantee compliance and make best use of possible benefits, ultimately adding to an extra effective and effective income tax return end result.

As you prepare to file your on the internet tax return in Australia, picking the best system is necessary to guarantee precision and simplicity of usage.In final thought, effectively browsing the online tax return procedure in Australia requires a thorough understanding of tax obligation obligations, thorough preparation of important records, and cautious option of a proper online platform.

Comments on “The Advantages of Submitting an Online Tax Return in Australia for Faster Processing and Refunds”